Excellence in design and naval architecture

We are a global ship design business with over 300 vessels in service across the world.

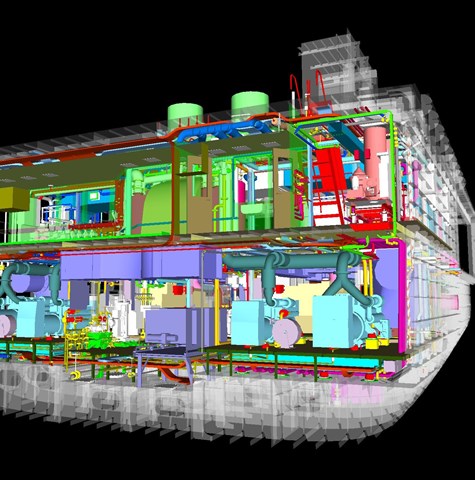

The key to our success is our reliability and our unrivalled track record of delivering challenging designs that consistently meet performance and specifications. Underpinning this ability is our innate understanding of issues related to production and our close cooperation with shipyards.

In addition to our proven vessel designs, we share our insight into performance requirements design and build implications to help price accurately and assure the quality of all our work.

Ship design is at the very heart of what we do, and our global teams continue to drive innovation across the industry.

Artificial intelligence has revolutionised ship design and changed how we work forever. However, apart from improving computer-aided design (CAD) tools, the creation of ship arrangements is relatively the same as in the 1980s.

Alfred, built at the Strategic Marine shipyard in Vietnam, for Pentland Ferries is the greenest ferry of its kind, using 60% less fuel than similar vessels in the area.

As the importance of climate change and its impacts are understood, the consequences will be felt by us all. We are already seeing the market demanding emissions reduction as the global shipping industry adapts to meet future regulations. Over the next 30 years, we expect innovation to accelerate and for enablers such as autonomous technologies to be increasingly adopted, allowing the global shipping industry to reduce its environmental impact, also becoming more efficient.

BMT’s ‘Energy Saving Technology (EST) Asset Leasing Models’ project announced as one of the competition winners in UK’s first funding call to industry

Our ‘Energy Saving Technology (EST) Asset Leasing Models’ project highlights our commitment to a future vision of efficient and sustainable shipping.

One of the most significant challenges of warship procurement is keeping pace with technological developments and changing strategic contexts.

Our Naval Architects speak to RINA Ship and Boat International about how we can assist our clients early on with Future Fuels for their next vessel design.

To complement our ship design offer and the move towards autonomous vessels, we support the development of maritime autonomous systems collision avoidance regulations. Our ship simulator REMBRANDT is at the cutting edge of autonomous navigation.

Chloe Yarrien discusses how Maritime Autonomous Systems (MAS) are not capable of solving every problem and meeting every need simultaneously, but they can be very useful and effective for certain tasks and applications.

Our Maritime Autonomous Systems Engineering Lead , Chloe Yarrien explores the emergence of ‘the six Ds’, delving into each of these dimensions to understand the transformative potential of marine autonomy.