Naval acquisition trends and their impact on innovation

One of the most significant challenges of warship procurement is keeping pace with technological developments and changing strategic contexts.

30 June 2021

Future warships need to be adaptable to allow regular upgrades or changes to be made throughout life, to take advantage of the latest technologies and avoid obsolescence while maintaining warfighting advantage. Exacerbated by the long acquisition cycles typically involved in developing complex systems combined with inflexible contracting, these factors can limit innovation opportunities, which will become an increasing problem as the rate of technological development accelerates and opportunities for novel technologies arise. We believe it will be necessary to challenge current practice and consider:

This article discusses some of the challenges and opportunities that procurement organisations, ship designers and shipbuilders face. It makes recommendations for changes that are likely necessary to achieve the above objectives.

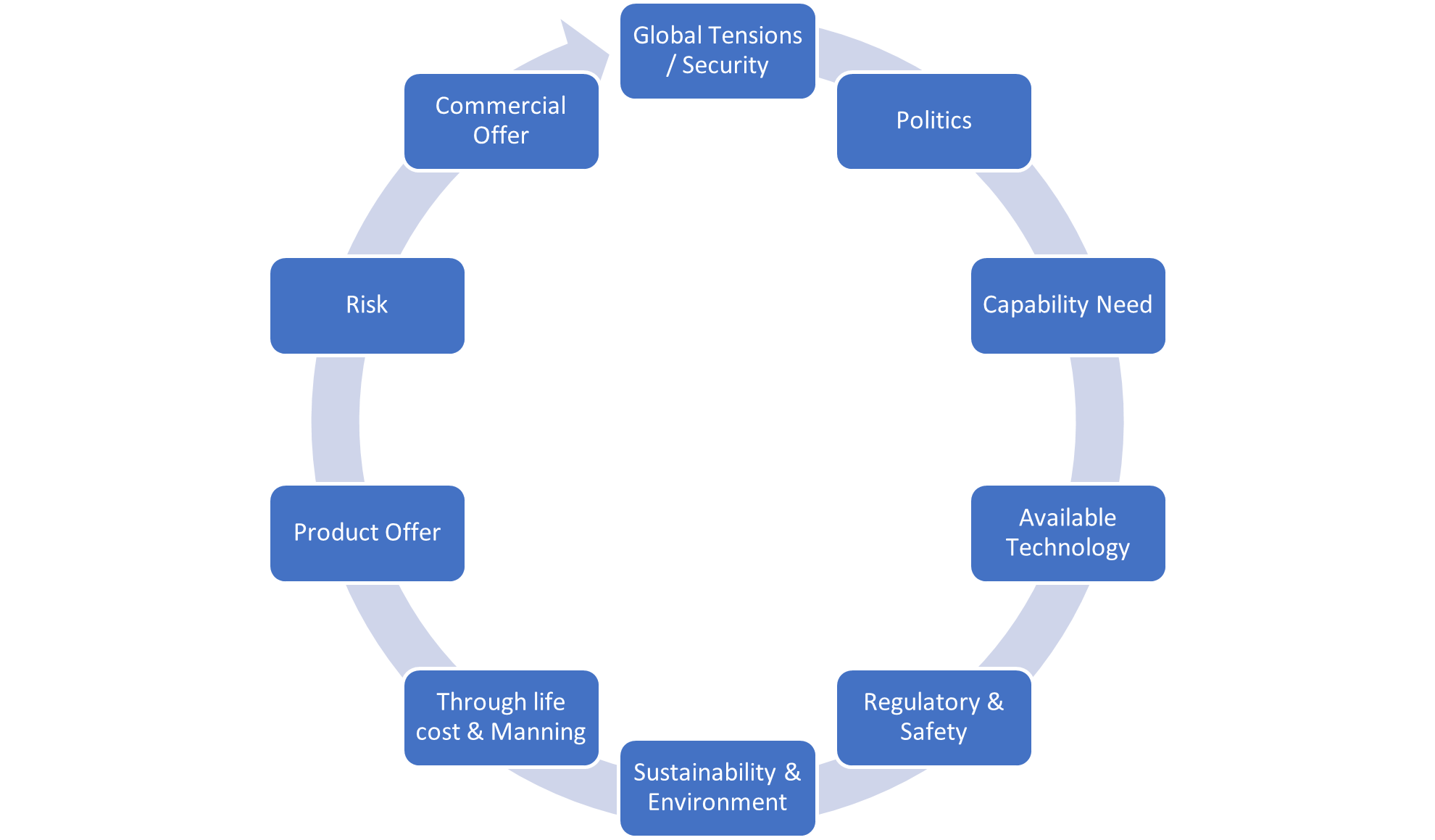

Global tensions and external factors drive the capability to counter evolving threats or provide maritime security presence. As technology develops, navies must adapt ships or submarines to enhance their effect or defend themselves from evolving threats. National shipbuilding strategies must recognise the importance of design and technology innovation as an enabler for export sales and the benefits to naval capability. Politics has always played a significant role in government acquisitions, where local content is a common theme to support national economies.

Technological advances, driven by the commercial sector, are drivers for change within the military domain. Military procurement has an opportunity to adopt these enhancements as they become available, leading to improvements in through-life capability.

Environmental considerations are playing an increasing part in new ship design projects with an ambition by many governments to reduce emissions to meet net-zero 2050 targets. Diesel-electric and hybrid solutions help reduce fuel consumption, and the addition of exhaust scrubbers and energy recovery devices is often specified. The following steps may include batteries or greener fuels. Still, there are some challenges to adopting these technologies in a naval environment, including increased hazards or higher demands on space. Increasing regulatory requirements enhance standards and safety but can slow the adoption of new technologies and increase development cycles. Through-life cost reduction is crucial for most navies, where automation and increased autonomy can drive innovation. However, costs can be challenging to balance if procurement and through-life costs are held separately. Intelligent procurement processes supporting life cost decisions can significantly improve but require robust cost modelling.

Another key challenge relates to crewing vessels in the modern navy. Recruiting is becoming challenging, and crewing is a significant contributor to through-life costs. The key challenges are maintaining a minimum crew for damage control, interfacing complex automation systems with humans, and assuring reliable and safe methods. The rapid development of digital and autonomous systems continues, but we will see a fully independent warship some years before. However, smaller autonomous and remotely piloted systems are in operation already. Therefore, integrating these systems into new and existing ship designs has become a high priority for most navies, and the adaptability of the ship is an important consideration. Existing plans from a limited number of suppliers may limit innovation, as they aim to minimise programme risk by using proven technologies wherever possible, which, combined with cost constraints and the unwillingness of procurement agencies to take on risks, has the potential to limit innovation.

There continues to be a trend for mission modularity within NATO nations. There is market demand for more flexible, versatile and multi-functional ship designs. The movement offers increased functionality from future ships by including multi-role features or building in greater adaptability to allow through life developments in line with technological advances. Still, in reality, this isn’t easy to achieve and may compromise the ship’s design and, therefore, its mission effectiveness. Our research at BMT suggests this compromise can be significant and needs to be carefully considered with a clear understanding of the concept of operations. Integrating new technologies without significant alterations to the ship requires margins in the design, alongside flexible infrastructure and open architectures that interface readily with new systems. These are the essential factors to get right at the specification stage.

There will be increased adoption of uncrewed systems in the naval domain, and successful integration into warships is essential. They will continue to develop in the coming years, combined with improved reliability to provide the required availability to support reduced manning. Greater levels of digitalisation and automation will also be necessary. The concept of operations will need to continually evolve to capitalise on the operational advantage that new systems offer.

Sustainability will also play an increasingly important part in naval shipbuilding, increasing focus on energy efficiency and reducing emissions. These goals will start to impact the wider supply chain, shipbuilding, and disposal activities more significantly.

Acquisition of warships is extremely challenging due to product complexity, limited opportunity for physical prototyping, complex government procurement processes, and political challenges, ‘i.e. short-term views driven by political cycles, cost constraints, programme risks, and the competitive environment. Procurement authorities want low risk and low cost, but they need innovation to give their armed forces the best tools they can afford. How can they manage this tension?

They need experienced programme management and engineering professionals, supported by a pragmatic and agile commercial function that can manage this complex risk environment in a way that does not make the programme unaffordable and allows for adopting new technologies as late as possible, which may require decoupling the platform from the mission systems to some degree, enabled by adaptable design, flexible and open infrastructure, modularity, and offboard systems. However, there needs to be a fundamental change to the procurement process to enable this. BMT is involved in naval procurement programmes across the globe, most significantly in the UK, USA, Canada, and Australia, each with slightly different objectives. Based on this experience and recognising the challenges outlined, the agile procurement model presented in figure 3 may offer several merits.

Industry studies adopted in the US help refine requirements, study design and technology options and test affordability. If a flexible design-led contract followed this, it would allow for technology insertion as late as possible in the design process. This approach would mitigate obsolescence and the cost escalation that would be experienced if a ship design and build contract had been placed earlier. Parallel technology development of ‘mission systems’, including modularity and autonomous systems development, based on agreed interfaces and integration parameters, would allow design progression. Still, the critical point is that flexibility and the ability to trade off requirements to enable technology adoption should remain. An option here is to introduce agile practices for high technology ‘modules’ while retaining more traditional acquisition methods for simpler ‘platforms’.

The government can receive the lowest fixed price contract due to significantly reduced design and selected technology options. The resulting approved baseline design can then be taken to tender. At this point, the plan’s maturity should include a partial detailed design, minimising the time to ‘cut steel’ date for the first class. An earlier selection of the shipbuilder is possible in this model. It might be necessary if they were responsible for procuring long-lead items, although the government could undertake this. This approach may place more risk on the government but removes risk (and therefore price) from the shipbuilder, improving overall programme outcomes. Alternatively, a programme management contractor could be selected to manage the whole or parts of the process on behalf of the government, with an appropriate commercial model employed to achieve the overall objectives, which must not remove the intended flexibility of the approach and can still allow competition for a build if the shipbuilding strategy requires that.

The adaptable ship design that results from this process can be upgraded through life via technology insertion. A digital twin* supports this technology insertion and maintains configuration control of the evolving ship and mission system configurations for each class member while optimising the asset’s performance in terms of performance, operating costs, availability, environmental impact training, and safety.

Will Roberts

At BMT, we believe simulation is a critical enabler in overcoming these hurdles—de-risking development, accelerating innovation, and building confidence across the entire lifecycle of autonomous systems.

N/A

Get ready to dive deep into maritime autonomy as we bring you technical experts, insightful opinions, and unmissable discussions.

Dr Thomas Beard

Episode 3 of IMarEST’s Ship Energy & Environment podcast series, addressed the ‘Realities and Challenges of Alternative Marine Fuels. Dr Thomas Beard, Clean Shipping Lead explores the practical side of the 'big four' alternative fuels.

Jake Rigby

We explore the core elements of the support framework required to ensure Persistent Operational Deployable Systems (PODS) can thrive.