11 January 2024

As global environmental concerns continue to mature, the demand for transparency and accountability in corporate practices grows as well. Climate change in particular has emerged as a defining issue, prompting businesses to reevaluate their environmental impact (in terms of direct and indirect carbon emissions), and the potential impacts climate and extreme weather events may have on their value creation. In Canada, the regulatory landscape is evolving rapidly on all fronts – from reporting to action - reflecting a growing awareness of the need for more sustainable practices and responsible business conduct.

Influenced by U.S, European Union and global sustainability disclosure initiatives, Canada is threading the needle of applicability to its own interests with standardization across the marketplace. Last year the U.S. Securities and Exchange Commission (SEC), the entity charged with regulating public U.S. companies, issued its guidance on climate-related disclosures. In January of 2023, the European equal of the SEC, (the Corporate Sustainability Reporting Directive, or CSRD) issued its own guidance. Where these regulations impact Canadian companies is whether Canadian firms have existing operations or are listed on any stock exchanges governed by these two regulating bodies.

While these regulators hash out the specifics of their disclosure rules, the globally recognized International Sustainability Standards Board (ISSB), released their final global standards in June of 2023. As a result, Canada created its own board (the Canadian Sustainability Standards Board, or CSSB) to take these global standards and ‘Canadianize’ them. Important to note, the resulting standards will govern a voluntary disclosure. However, the Canadian Securities Administration (CSA), the Canadian version of the SEC or CSRD, is one Canadian regulator among others that will likely adopt some form of the resulting CSSB standards. Adding another confirmation of direction, the CSA has issued their own climate rule intending to align with the ISSB (and the resulting Canadian version).

Although the resulting CSSB standards are yet to be released, companies must prepare their organizations and disclosure mechanisms for requirements that are likely to be included. These climate disclosures will likely take the form of the ISSB standards, with regional variations expected.

The regulatory agency tasked with implementing and evaluating these disclosures will also depend on the industry, type of company, and regulatory body overseeing them. For example, the Office of the Superintendent of Financial Institutions (OFSI) aims to integrate climate-related financial risks into decision-making processes across the financial sector. As previously mentioned, public Canadian companies will be regulated by the CSA’s climate rules, and Canadian companies listed on U.S. exchanges by the SEC.

As Canada is progressing in acknowledging the importance of climate risk disclosure, the mandating of reporting in alignment with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) is an important development. Spearheaded in Canada by the Bank of Canada and the Office of the Superintendent of Financial Institutions (OSFI), TCFD offers a comprehensive framework for organizations to assess and disclose climate-related risks and opportunities. It should also be noted that the IFRS converged its standards with TCFD, further cementing its place in the disclosure landscape.

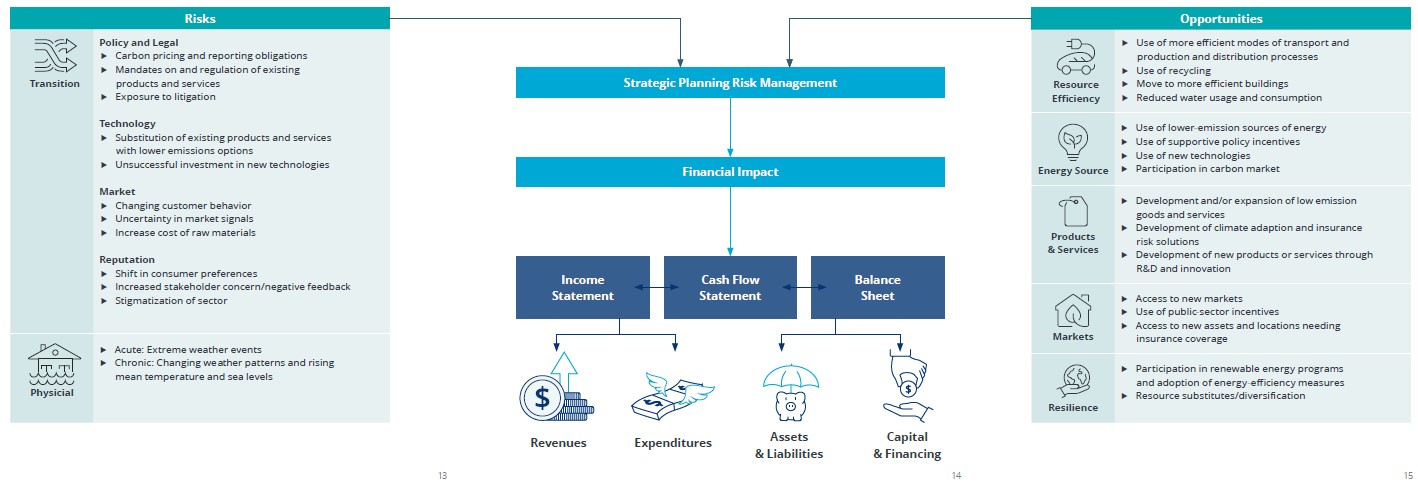

Preparing your organization for these upcoming disclosures can largely begin by aligning with the existing TCFD framework. Developed after the 2015 Paris Agreement, it aims to consolidate and standardize climate reporting from physical and transitional risks to the various opportunities that may also arise from climate change. The ISSB standards includes the TCFD disclosure framework, of which climate related risks and opportunities makes up a part. As such the final regulatory thrust will likely take the shape of TCFD requirements, with a unique Canadian lens applied throughout.

A key facet of TCFD is understanding risks and opportunities from changes to policy and regulatory regimes. Stemming from Canada’s recognition of the urgency of climate change, the Canadian government’s commitment to achieving net-zero emissions by 2050 has paved the way for increased domestic regulatory requirements related to emissions and decarbonization. While these regulatory initiatives signify progress, the challenge lies in ensuring that they are robust enough to drive meaningful change. Balancing in-depth, bespoke disclosure with bland, one-size-fits-all approaches is essential to accommodate the diverse nature of industries operating within Canada.

Investors in various fields may also recognize the economic and physical implications of climate change and increased extreme weather on long-term investment strategies. As such, companies will use these disclosure avenues to adopt transparent reporting practices and develop resilience strategies that are unique to their businesses, and turn to consultants for the necessary strategic and engineering advice. This, in turn, encourages businesses to integrate climate considerations into their overall risk management strategies.

Overall, while significant progress has been made by TCFD to connect climate change issues to financial markets, there remains, above the legislative approval of disclosure requirements, a lack of transparency around the content standards and consistency across businesses and industries for disclosure.

To fortify the current state of climate disclosure in Canada, a concerted effort is required from all stakeholders – businesses, regulatory bodies, investors, and the public as consumers of goods and services. Achieving more standardized, industry-specific reporting frameworks would enhance the comparability of disclosed information and facilitate better decision-making.

Blending climate science with a deep technical understanding of engineering concepts across key industry sectors such as Defence, Energy, Maritime and Government, we can help decipher and unpack the applicable requirements related to climate risk and opportunities for your organization as well as develop practical recommendations and strategies for risk mitigation.

Jaret Fattori is a Professional Engineer registered with Professional Engineers Ontario with expertise in infrastructure restoration, carbon reduction and climate change resilience. He is based out of our office in Ottawa, Canada, and leads the development of BMT’s climate and environmental capabilities in North America.

Jaret’s academic qualifications include a Bachelor of Engineering in Civil & Environmental Engineering from Western University, London, ON, and a Master of Engineering in Sustainability Engineering from Queen’s University, Kingston, ON. He possesses over 7-years of professional history which includes leading many impressive cross-disciplinary projects evaluating climate risk, opportunity, and strategy across Canada.

Fattori uses his background in environmental and civil engineering, as well as his expertise in climate change science, to advise clients on climate resiliency, carbon emission reduction, and sustainability. His technical background and analysis help clients assess climate change risk for existing and new infrastructure projects. He is experienced in presenting technical concepts to a variety of audiences and coordinating the efforts of multi-disciplinary teams to provide robust climate risk analysis.

N/A

The DCN spoke to our climate change risk, resilience and adaptation expert about preparing for the impacts of a changing climate.

N/A

With the UK and beyond facing unprecedented consequences from rising water levels and climate amelioration, BMT are helping our clients in their need for flood alleviation, prediction, mapping and mitigation. James While talks about 5 ways we can assist our clients.

Ian McRobbie

In a Port Strategy feature, Ian McRobbie highlights the merits of optimising bulk transshipment through ‘Climate-Smart’ simulation technology, drawing on extensive project experience

Jaret Fattori

Jaret Fattori's article in Port Strategy discusses how ports are adapting to climate change and IFRS S-2 regulations. Emphasising the shift towards sustainability through digital integration, decarbonisation, and innovative fuel alternatives, he explores the significant role of collaboration in advancing port sustainability and innovation.