So you want to decarbonise your fleet?

We look at how the maritime sector approaches decarbonisation and other green shipping initiatives.

29 May 2022

As maritime companies explore targets for low carbon and greener shipping, Greg Fisk and Noel Tomlinson discuss the state of play on all decarbonisation and green shipping and how the maritime sector is approaching the issue.

Noel: Decarbonisation is a critically important issue for maritime. Although ships remain one of the most efficient methods of transport - with over 90% of the world’s goods transported by sea - it is a critical sector in society’s journey to decarbonise. The Intergovernmental Panel on Climate Change (IPCC) has identified the need to act in the immediate ten years, not just aim for 2050. So there is much more focus now, from a climate perspective, on science-based targets and the need to keep temperature rises under 2 deg C.

The emissions generated in the shipbuilding process are significant and need to be considered if we move towards a decarbonised model. It is also vital that we consider the whole lifecycle of the vessel from concept to disposal. But along the way, investment, regulation, and technology are and will continue to be fundamental drivers in maritime decarbonisation.

Starting with investment, as the sector tends to deal in high-value and long-life new assets and infrastructure required to support decarbonisation, access to finance and the confidence to invest are critical. Investment in vessels that utilise alternative fuels or energy-saving technologies also drives demand for ports to invest in the associated shore-based infrastructure. Such infrastructure gives vessel owners the confidence to invest in alternatively fuelled vessels knowing the supporting infrastructure will exist to operate them.

Regulation is another key driver, and the recent introduction of an Energy Efficiency Design Index (EEXI) and Carbon Intensity Indicator (CII) by the IMO last year will force large vessel operators and owners to take action.

Finally, technology plays a massive role in unlocking the pathways to decarbonisation. Future changes in technology will fundamentally change how the maritime sector operates, from alternative fuels and propulsion systems to autonomy, digitalisation and energy-saving technologies. Investment in technology will also mature it to the point where it can be commercially deployed on the scale required. Investment in fuel production will reduce alternative energy costs to a commercially viable price point.

If these three factors of investment, regulation and technology can all be developed in parallel, then the vision of net zero shipping operations can become a reality by 2050. However, the journey to get there starts now, and we cannot lose focus on the near-term targets.

Noel: Clearly, the decarbonisation of the maritime sector will take a phased approach, and within this, many of the options will play a part. Some are purely short-term and interim solutions, and some as potentially end-state solutions.

There are well over ten available and feasible alternative fuels right now, let alone the ones in development and those still to be discovered in the decades leading up to 2050, so choosing one is not easy. However, it should also be recognised that several alternative fuels have a lower power density than carbon-based ones, so vessel efficiency can significantly impact feasibility and adoption.

Currently, fuel options can be grouped into three broad categories based on their type: Fossil fuels, Biofuels and Renewable (green) fuels.

Fossil Fuels include traditional Heavy Fuel Oil (HFO) and marine diesel but also have the more recent low sulphur fuels, LNG, LPG and methanol. Although not likely to be the solution, these fuels continue to be used widely. They will continue in the short term, meeting other environmental commitments to reduce sulphur and particulate air pollution.

Good quality biofuels and synthetic fuels are becoming more readily available. These, however, provide an excellent alternative to diesel and can be used in four-stroke, medium- and high-speed engines allowing existing vessels to be converted to operate on biofuels. Still, reliable supply and price are vital issues mainly due to the scale of production and a limited supply of sustainable resources before demand outstrips supply.

Green fuels produced from renewable sources can provide a longer-term solution and include green hydrogen, ammonia and fully electric storage solutions. The safety considerations with storage, handling and usage can be significant, and bunkering logistics depend on the fuel type.

In summary, we can say that the future is uncertain, and the right fuel will vary depending on the application domain and regional availability. Supply flexibility and resilience will be critical, so design adaptability or multi-fuel solutions will be essential for early adopters.

Noel: An effective shipping transition isn’t simply a case of replacing fossil fuels with cleaner alternatives like ammonia or methanol. The total emissions generated throughout an alternative fuel’s life cycle must be considered using what is often referred to as a “well-to-wake” approach. From developing the electricity that helps produce, for example, green methanol (the well), to the greenhouse gases a marine vessel creates using the fuel (the wake).

One of the biggest obstacles to overcome is the cost and availability of the fuel itself. That is primarily driven by the production and distribution infrastructure, ultimately driven by demand. When it comes to coastal vessels, ferries, harbour vessels, short sea shipping and offshore wind support vessels, for example, a local infrastructure solution can work very well as the ships are typically regularly going in and out of the same ports, which is very different when we look at deep sea vessels, operating on global routes and calling at many other ports, which then requires a genuinely global solution which works across many different countries all with very different infrastructure, investment, regulation and governmental policy. Progress is being made in international policy with the planned creation of “green shipping corridors” where infrastructure is provided to allow specific international routes to become reliably decarbonised. These flagship “green shipping corridors” formed by global collaboration could form the stepping stones for wider decarbonisation.

Noel: The industry’s current focus is reducing carbon emissions by reducing overall energy usage through a wide range of energy-saving technologies (ESTs). In this growing industry, a number of the principles have been around for a very long time, and the speed of technological advancements means that more are coming to market and being more readily adopted. ESTs are expanding and come with various associated capital investment costs, performance benefits and levels of integration complexity. However, accurate vessel-specific modelling and analysis of ESTs ares often required to select the most effective selection or combination of ESTs, which is essential to making an informed cost-benefit decision and maximising return on investment.

From a longer-term planning perspective, decarbonisation is a whole journey and what is important now is to have a strategy or plan with some form of roadmap of how we get from today’s assets and today’s operational profile to a sustainable future, which is likely to be a long-term plan over tens of years and although we are unlikely to have all the answers today, by understanding the potential pathways we can make more informed decisions reducing risk and increasing the efficiency of investment. The roadmap should also have short-term targets to meet the challenges of new regulations such as the IMO’s EEXI and CII, keeping an eye on both short-term goals and longer-term visions, which can be a complex challenge. The answer will not be the same for every owner or operator as the roadmap will depend on the size, age, type, routing, and operational profile of each vessel in a fleet, along with external variables like infrastructure, policy, fuel cost and fuel availability.

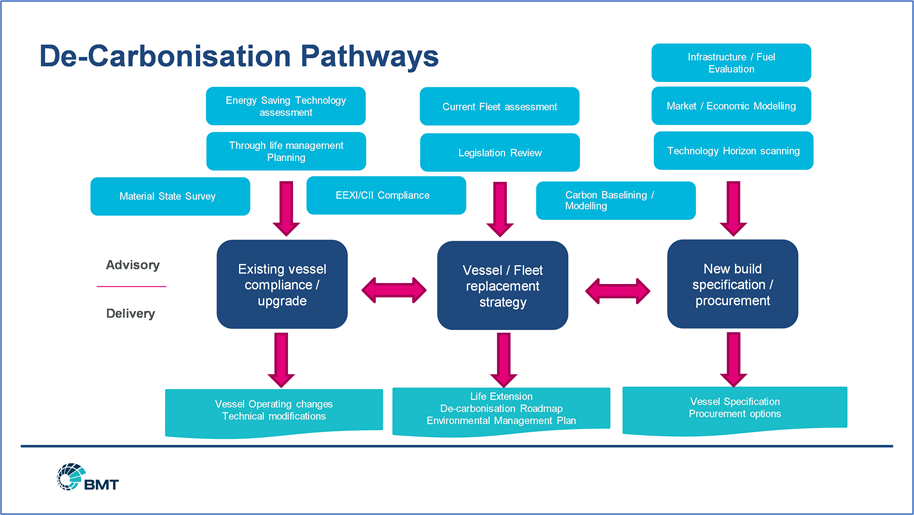

As shown in the diagram below, BMT has developed some simple tools to assist our maritime clients in undertaking a holistic approach and support the creation of a fleet decarbonisation pathways approach which covers three main areas:

(i) existing vessel compliance and upgrade,

(ii) development of a fleet replacement strategy

(iii) specification and procurement of new vessels.

Greg is a Senior Associate at BMT and leads the firm’s global campaign related to climate risk and resilience. Based in Brisbane, Australia, Greg has over 25 years of experience in natural hazard and climate change planning and adaptation studies with planning, transport, and conservation authorities.

Noel is a senior business leader with a passion for ensuring high standards and quality of delivery and a track record of delivering growth. He uses his vision and market knowledge to grow market share by setting strategic business direction and successfully leading the delivery of the sales and marketing function. He has over 20 years' experience in the maritime sector, working within both defence and commercial maritime.

Will Roberts

At BMT, we believe simulation is a critical enabler in overcoming these hurdles—de-risking development, accelerating innovation, and building confidence across the entire lifecycle of autonomous systems.

N/A

Get ready to dive deep into maritime autonomy as we bring you technical experts, insightful opinions, and unmissable discussions.

Dr Thomas Beard

Episode 3 of IMarEST’s Ship Energy & Environment podcast series, addressed the ‘Realities and Challenges of Alternative Marine Fuels. Dr Thomas Beard, Clean Shipping Lead explores the practical side of the 'big four' alternative fuels.

N/A

Delve into the top 10 challenges and interdependencies involved in selecting and adopting from the plethora of technological developments, and then embedding multiple new technologies in frontline UK policing, highlighting the multifaceted nature of this undertaking.