Singapore exchange to require greater climate-related disclosures

The Singapore Exchange Regulation, the regulatory arm of the Singapore Exchange, makes climate-related disclosures mandatory for companies.

29 October 2021

In August this year, the Singapore Exchange Regulation, the regulatory arm of the Singapore Exchange, proposed to make climate-related disclosures mandatory for companies from 1 January 2023, starting with critical sectors, including finance, energy and transportation, and expanding to other industries in 2024.

Given Singapore’s role as a financial hub and regional headquarters for many multinational companies that care deeply about climate change and operate in multiple jurisdictions, this is a significant development.

The announcement also follows extensive guidance provided by the Green Finance Industry Taskforce (convened by the Monetary Authority of Singapore) in May 2021 contained within the Financial Institutions Climate-related Disclosure Document (FCDD). The FCDD aims to highlight leading environmental disclosure practices to serve as a practical reference as financial institutions step up their efforts in environmental disclosures. The FCDD has focused on climate-related exposures, adopting the Task Force on Climate-related Financial Disclosures (TCFD) recommendations as the guiding framework for disclosure.

Greg Fisk, Global Lead, Climate Risk and Resilience, BMT said, ‘With this announcement, Singapore joins the growing list of countries where investors and financial regulators are seeking greater transparency and disclosure around how companies and organisations are approaching their ‘net zero’ targets; but also, to understand and respond to the increasing physical risks from climate change and extreme weather on business assets, operations and workforces.”

Singapore’s move reflects a global push from investors and financial regulators for more companies and countries to meet Paris Agreement targets through an energy transition to lower carbon-emitting sources and to understand and respond to the increasing physical risks from climate change and extreme weather on business assets, operations and workforces.

The reporting reforms are proposed to occur over a phased approach as follows:

|

For the financial year commencing |

Baseline reporting practice |

Calendar year in which the report published |

|

1 January 2022 |

All issuers to adopt climate reporting on a comply or explain the basis |

2023 |

|

1 January 2023 |

Climate reporting will be mandatory for some sectors of issuers, with the compliance or explanation basis remaining for others |

2024 |

|

1 January 2024 |

More sectors will be required to adopt the mandatory requirements; all the others need a comply or explain the basis |

2025 |

Source: https://www.sgx.com/regulation/public-consultations/20210826-consultation-paper-climate-and-diversity

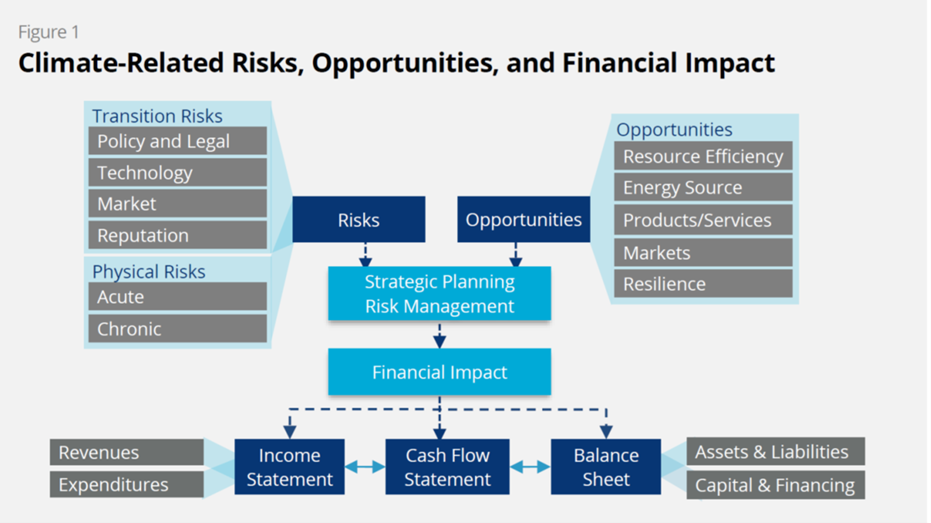

The adopted TCFD reporting framework covers four core areas for firms to disclose their approach to managing the financial implications of climate change:

Governance: Governance around climate risks and opportunities.

Strategy: The actual and potential impacts of climate-related risks and opportunities on design and financial planning.

Risk management: How the organisation identifies, assesses and manages climate-related risks.

Metrics and targets: The metrics and targets used to assess and manage climate-related risks and opportunities.

Shivaprakash Rao, Head of Consulting, Critical Infrastructure & Energy Transition, BMT Asia Pacific said, "Climate-related disclosures are under an ever-increasing spotlight of regulators and investors, and rightly so for enterprises to demonstrate that climate-related risks are being managed to ensure business continuity so as to preserve and grow shareholder's value. We at BMT are not only passionate about assisting our clients with better decision making and with sustainable solutions but see our contributions as part of the larger mission to hand over green and sustainable Earth to our future generations."

A sound understanding of risk and opportunity from climate change is at the heart of adequate climate financial disclosure, which should draw upon a combination of science, engineering, economics, and business management to be done successfully.

With increasing international pressure to decarbonise across supply chains, now is the time to build climate change-related literacy within organisations and establish approaches to ensure businesses and industry transition and continue to be viable into the future.

Credit: Figure 1 is appended from the Taskforce Final Report on Climate-related Financial Disclosures (2017).

With relevant expertise across all of these disciplines in-house and with over two decades of experience assessing technical, operational and financial risks in the Asia Pacific region, BMT is primed to support our clients and customers to understand and demystify the implications of climate change for their business but also to develop appropriate pathways toward resilience.

The company’s key capabilities in climate risk and resilience include:

Awareness training and knowledge brokering around climate change science, decarbonisation and building strength.

Risk assessments - from first pass screening to detailed risk analysis carried out by International Standards (ISO) across future emission scenarios.

Decarbonisation strategy development and target setting to allow clients to be ‘market ready’ as more and more countries commit to ‘net zero’ pledges.

Resilience advice utilising best practice tools and technologies to understand impacts from natural hazards such as flooding, storm tide and heatwaves at the site or property level

Assessment of transition technology and infrastructure to mitigate risks, cost-benefit analysis and timing of deployment

Economic analysis of impact pathways and solution options to inform climate-related disclosures, financial planning, and financial viability studies are required to align with TCFD recommendations.

Greg is a Senior Associate at BMT and leads the firm’s global campaign related to climate risk and resilience. Based in Brisbane, Australia, Greg has over 25 years of experience in natural hazard and climate change planning and adaptation studies with planning, transport, and conservation authorities.

Shivaprakash Heads the Consulting and Energy Transition department in BMT Singapore. He has 27 years of experience in Energy and Coastal Infrastructure projects. He is a Chemical Engineer by training with MBA in Finance, and a PMI certified Project Management Professional (PMP).

N/A

The DCN spoke to our climate change risk, resilience and adaptation expert about preparing for the impacts of a changing climate.

N/A

With the UK and beyond facing unprecedented consequences from rising water levels and climate amelioration, BMT are helping our clients in their need for flood alleviation, prediction, mapping and mitigation. James While talks about 5 ways we can assist our clients.

Ian McRobbie

In a Port Strategy feature, Ian McRobbie highlights the merits of optimising bulk transshipment through ‘Climate-Smart’ simulation technology, drawing on extensive project experience

Jaret Fattori

Jaret Fattori's article in Port Strategy discusses how ports are adapting to climate change and IFRS S-2 regulations. Emphasising the shift towards sustainability through digital integration, decarbonisation, and innovative fuel alternatives, he explores the significant role of collaboration in advancing port sustainability and innovation.