Mergers & acquisitions – improving Singapore’s maritime competitiveness

Singapore's port has historically been a critical driver of Singapore's connectivity and competitiveness and will continue to be one.

8 April 2022

Singapore's port has historically been a key driver of Singapore's connectivity and competitiveness and will continue to be one.

Maritime Singapore is an important economic pillar, establishing Singapore as a global hub port and thriving international shipping center. Hence, the Singapore Government continues to make significant moves to make its maritime sector competitive which includes bringing best in class globe expertise and operations into the Singapore maritime ecosystem.

Port tugs and harbour tugboats are an important element in port activity and navigational safety issues. Port tugs ensure the safety of big ships while they are entering, manoeuvring, mooring and unmooring, and are of huge importance during other port operations to ensure quick turnaround of calling ships. In essence, tugs play a critical role to ensure Singapore’s maritime shipping and port activities are conducted efficiently and safely.

After having established dominant positions in their native markets, organisations are always on the look-out for opportunities to grow into other markets as part of their growth and geographical diversification strategy.

A Global tug operator, having established market eminence was scouting for opportunities to grow in the ASEAN region. Singapore’s plan to increase its maritime sector’s competitiveness offered the perfect opportunity for market entry. However, the operator’s investment decision hinged on determining the market’s future potential, regulatory requirements, competition, and profits.

With extensive knowledge of the maritime shipping and ports in the region, we were appointed to undertake the technical and commercial due diligence for the target tug fleet on the behalf of the buyer, the scope of which included market demand underpinnings, asset quality and valuation uncertainty.

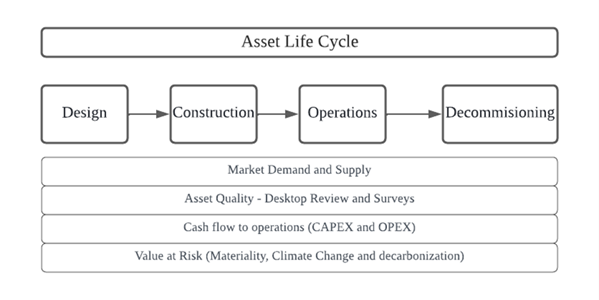

We take a holistic approach to due diligence which involves understanding the quality of the assets from a life cycle perspective. Our experts in the investment, shipping, and ports sectors examined the asset from design, construction, operations, and decommissioning angles to determine risks to revenue, profitability and cash flow.

Figure 1: BMT Asset Life Cycle Perspective

The due diligence conducted involved understanding the market evolution for the next 20 years impacting the market demand for the tug services, the market that the buyer could capture in the evolving market and the competitive positioning. Our team conducted desktop and vessel survey assessments of the fleet to ensure material risks were identified and that the assets were valued accurately.

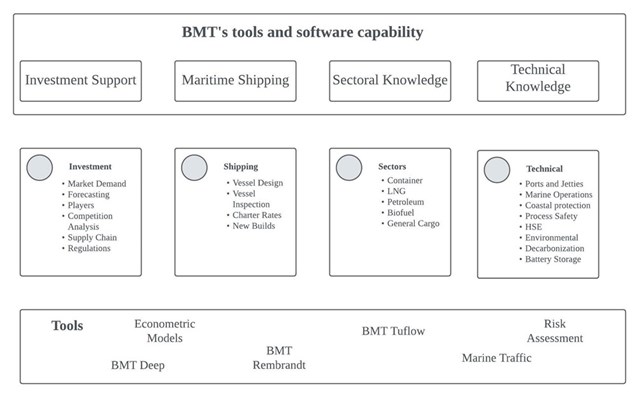

Figure 2: Due Diligence Process a deep dive for insights

The due diligence process involved bringing our inter-disciplinary knowledge to the forefront. With our understanding of the ASEAN region and markets, used economics experts for market forecasting, vessel experts to assess the quality and asset integrity of the fleet and LNG and maritime decarbonisation technology experts to understand future trends and implications to the existing fleet. With this capability in maritime operations we examined the assets for regulatory compliance, HSE, operating procedures, repairs and maintenance, and organisational capability.

Every assignment has its own challenges and, in this instance, we looked at the evolution of the alternative maritime fuel and its impact on the tug fleet. The value of the tug fleet was determined to be higher for low carbon transition fuel such as LNG. The option of battery-operated tugs and its comparative assessment with fossil fuel tugs was examined.

Figure 3: BMT’s one-stop capability and pool of Subject Matter Experts

These risks served as the input for deal negotiation and final contract signing. All the risks were classified based on the severity with material risks flagged early during the deal marking.

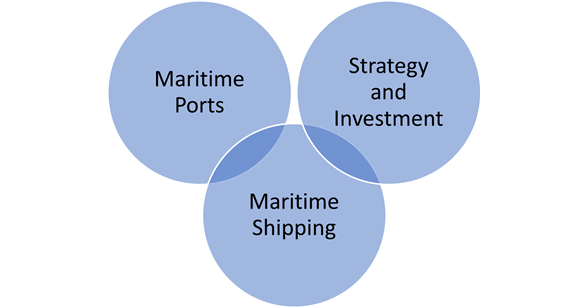

Our deep knowledge of the maritime and shipping sector, regional markets and the needs of the due diligence process looks are risks at the intersection of knowledge. With its pool of experienced Subject Matter Experts (SMEs), we offer one stop solution and confidentiality to clients to undertake a successful deal.

Figure 4: Value and Insights from intersection of knowledge areas

Our capabilities to support our customers across all stages of project development:

Market Study

Global, Regional, and national maritime industry assessment

Sectoral assessment – containers, LNG, and Oil

Vessel design

Vessel Survey

Risk Assessment

Economic modelling and Valuation

Eric Jin heads BMT’s Investment Support Division for maritime consultancy and coastal infrastructure services and is well experienced with the shipping and port industry including global top port operators.

Eric's role is focused on helping clients realize group level growth initiatives such as strategic development, operation assessment and financial performance. Areas of work include market development, terminal operations, group-operating ports financial performance, port development planning, infrastructure and port engineering, cost of sales assessment as well as the commercial and technical due diligence M&A activities.

On commercial and technical due diligence in particular, Eric has involved in a wide range of large-scaled transaction in the shipping and port industry, including a global portfolio transaction . Eric has led the commercial advisory in this transaction for market assessment, business outlook and volume forecast, market competition, tariff review and price trends, customers analysis, services and operations review including service performance and operating cost assessment and forecast.

Eric's experience spans many geographies and has been responsible for commercial and technical due diligence including a variety of port development projects in Hong Kong, Malayasia, North America, Myanmar, Thailand, Indonesia and Vietnam.

N/A

The DCN spoke to our climate change risk, resilience and adaptation expert about preparing for the impacts of a changing climate.

Ian McRobbie

In a Port Strategy feature, Ian McRobbie highlights the merits of optimising bulk transshipment through ‘Climate-Smart’ simulation technology, drawing on extensive project experience

Jaret Fattori

Jaret Fattori's article in Port Strategy discusses how ports are adapting to climate change and IFRS S-2 regulations. Emphasising the shift towards sustainability through digital integration, decarbonisation, and innovative fuel alternatives, he explores the significant role of collaboration in advancing port sustainability and innovation.

Ian McRobbie

Ian McRobbie, our Programme Manager for Ports and Maritime Infrastructure, was interviewed by Port & Harbors to discuss how infrastructure companies are collaborating with ports to enhance port infrastructure and operations.